American Express AE1425 2006-2025 free printable template

Show details

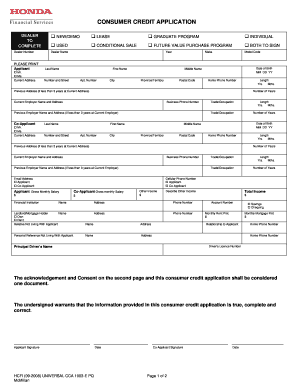

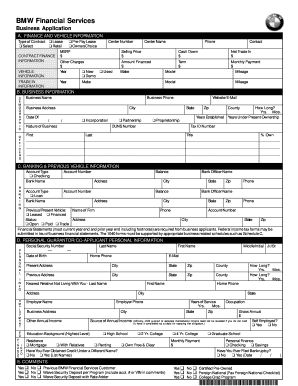

Your application for the Gold Credit Card from American Express 1. PLEASE COMPLETE THE FOLLOWING APPLICATION USING BLOCK LETTERS To ensure fast processing of your application please complete the following questions. Any increase will be subject to a review of your Account and we reserve the right to decline your balance transfer application should we decide not to increase your limit. Any increase will be advised in your statement and will be rounded up to the nearest 100. All payments to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign credit card application form

Edit your credit card application form printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card application form image form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card application image online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit printable credit card applications form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card application form

How to fill out American Express AE1425

01

Collect necessary personal information: Name, address, social security number, and income details.

02

Access the American Express AE1425 form either online or in physical format.

03

Start by filling out the section for personal information accurately.

04

Proceed to the financial information section, detailing your income sources.

05

Review the terms and conditions provided and ensure you understand them.

06

Sign and date the application form where required.

07

Submit the completed form either online or by mailing it to the specified address.

Who needs American Express AE1425?

01

Individuals looking to apply for an American Express credit card.

02

People seeking to manage their finances with a reputable credit provider.

03

Borrowers wanting to benefit from rewards programs offered by American Express.

Fill

credit card application printable

: Try Risk Free

People Also Ask about credit card application form online

Can you apply for Lowe's credit card online?

If a Lowe's credit card is right for you, visit Lowe's Credit Card Services to learn more about the Lowe's Advantage Card as well as other credit card options that we offer. Begin the application process online or visit a Lowe's home improvement center near you.

Is it hard to get approved for a Lowes credit card?

The Lowe's Advantage Credit Card is reported to be among the more difficult store cards to get, generally preferring applicants with "fair" credit or better (FICO scores above 620). While you can apply for the Lowe's card online, it's recommended that you apply in-store to take advantage of the one-time signup offer.

Is it easy to get approved for a Lowes credit card?

The Lowe's Advantage Credit Card is reported to be among the more difficult store cards to get, generally preferring applicants with "fair" credit or better (FICO scores above 620). While you can apply for the Lowe's card online, it's recommended that you apply in-store to take advantage of the one-time signup offer.

Can you use Lowes credit card same day you apply?

Yes, you can use your Lowe's Store Card instantly after approval. More specifically, once you get approved, you will get a temporary pass for your new card. Just keep in mind that you have to call customer service at (800) 444-1408 before using it.

How to qualify for a Lowes credit card?

The credit score that you need for the Lowe's Store Card is 640, at a minimum. That means people with at least fair credit have a shot at getting approved for this card.

Can I get a Lowes card with a 600 credit score?

What credit score do I need for a Lowe's card? You'll likely need a fair, good, or excellent credit score to qualify for the Lowe's credit card. Fair credit scores typically start around 600. Good scores start around the high 600s, and excellent scores start around 800.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the printable credit card application in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your blank credit card application and you'll be done in minutes.

How do I edit american express ae1425 edit straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing credit card application form design.

How do I fill out the credit card application online form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign credit card application form illustration and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is American Express AE1425?

American Express AE1425 is a specific form or document used for reporting purposes, typically related to business expenses, transactions, or customer account activities associated with American Express.

Who is required to file American Express AE1425?

Individuals or businesses that engage in transactions or activities requiring the documentation provided by American Express AE1425 are required to file this form, particularly if they meet certain thresholds or criteria set forth by American Express.

How to fill out American Express AE1425?

To fill out American Express AE1425, individuals need to provide necessary information as prompted on the form, which may include details about transactions, business expenses, and identification information. Following the instructions that accompany the form ensures accurate completion.

What is the purpose of American Express AE1425?

The purpose of American Express AE1425 is to facilitate the reporting of transactions, tracking of expenses, and compliance with financial regulations, thereby ensuring transparency and accuracy in financial dealings.

What information must be reported on American Express AE1425?

The information that must be reported on American Express AE1425 typically includes transaction details, amounts, dates, descriptions of expenditures, and relevant identification information of the account holder or business.

Fill out your American Express AE1425 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Cards Application Form is not the form you're looking for?Search for another form here.

Keywords relevant to lowes credit card application

Related to american ae1425

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.